pet insurance small dog: flexible comparisons for smarter coverage choices

Why small dogs deserve a slightly different lens

Vet bills don't scale down with size, yet medications sometimes do. That tension makes coverage decisions for a small dog a bit different. You're weighing lower day-to-day costs against risks that can be breed-specific or long-tail. I'm reasonably confident a thoughtful comparison helps most families, though exact savings will vary by age, breed, and ZIP code.

- Dental disease: Tiny mouths crowd teeth; cleanings and periodontal treatment matter. Check whether the plan covers dental illness, not just accidents.

- Orthopedic quirks: Patellar luxation appears often in toy breeds; some carriers impose special waiting periods or exam requirements.

- Airway issues: Collapsing trachea or brachycephalic airway problems may need ongoing care; confirm chronic-condition coverage.

- Cardiac and congenital conditions: Mitral valve disease and shunts can be costly; verify hereditary/congenital inclusion.

- Chronic care horizon: Small dogs can live longer, so long-term medication limits and annual caps matter more than you'd think.

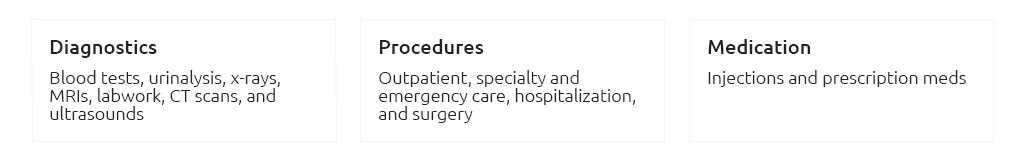

Plan types, compared at a glance

- Accident-only: Lower premium, covers injuries from events like cuts or fractures. Pros: Cheapest, good for emergency-only protection. Cons: No illness coverage, which is where small breeds often rack up costs.

- Accident & illness: Core option for most owners. Pros: Broad medical coverage; often includes hereditary conditions. Cons: Higher premium; exclusions and waiting periods require careful reading.

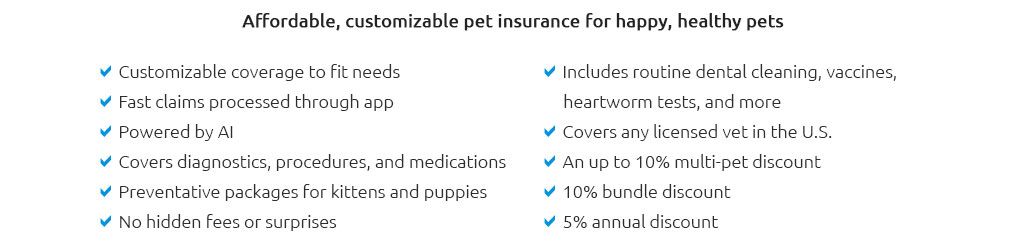

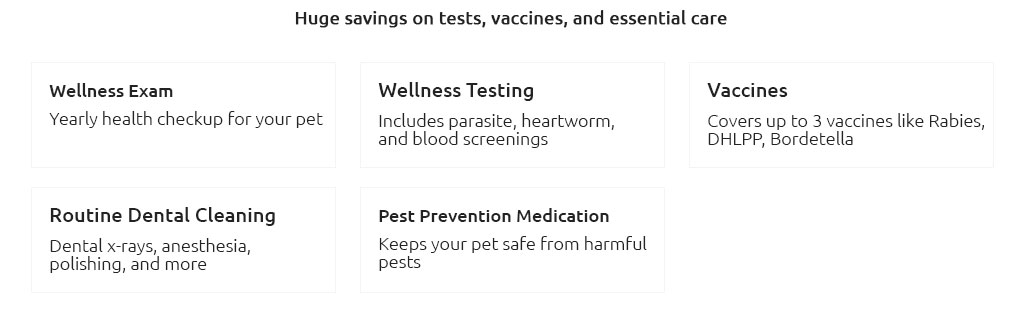

- Wellness add-ons: Routine care like vaccines and cleanings. Pros: Budget smoothing, potential dental clean coverage. Cons: May not "save" money; useful if you value predictable cash flow.

Cost drivers and rough ranges

Quotes change by company, but typical accident & illness premiums for a young small dog often fall roughly between $20 - $60 per month in many areas, drifting toward $60 - $120+ with age. Not a promise - just a ballpark so you can sanity-check quotes.

- Age: Increases gradually; steepens in senior years.

- Breed risk: Toy breeds with known issues can rate higher.

- ZIP code: Urban care costs push premiums up.

- Annual limit: $5k vs unlimited meaningfully changes price and protection depth.

- Deductible & reimbursement: Higher deductible and lower reimbursement reduce premiums but raise out-of-pocket risk.

- Exam fees: Some plans exclude them; that adds up with frequent visits.

Choosing deductible and reimbursement

If your small dog tends to see the vet often (dental, chronic cough checks), a lower deductible can make sense. If you're primarily catastrophically focused, a higher deductible paired with an 80 - 90% reimbursement and a strong annual limit keeps worst-case costs manageable. I can't guarantee the "cheapest" setup every year, but you're likely to reduce swings in big bills with adequate limits.

Coverage details worth reading slowly

- Hereditary/congenital: Covered, capped, or excluded? Any breed-specific clauses?

- Dental illness: Periodontal treatment vs accidents only; anesthesia and X-rays included?

- Bilateral conditions: If one knee has issues, is the other knee excluded as "pre-existing" later?

- Exam fees: Included during illness/accident claims?

- Rehab and alternative care: Hydrotherapy, acupuncture - useful after orthopedic procedures.

- Behavioral therapy: Sometimes covered with caps; handy for anxiety-related issues.

- Prescription diets and supplements: Often excluded or limited.

- Waiting periods: Standard, plus special orthopedic waiting or exam waivers.

Small-dog specifics to flag

- Patellar luxation: Look for specific language; some require an orthopedic exam to shorten waits.

- Tracheal collapse: Chronic condition coverage matters; stent surgery is high-cost.

- Mitral valve disease: Check for lifetime condition caps and med coverage.

- Dental: Professional cleanings and periodontal therapy can prevent bigger claims; see how wellness and illness interplay.

A quick real-world moment

At the park, your 9-lb mix cuts a paw on glass. The urgent-care visit, sutures, and meds total $640. With an $250 deductible and 80% reimbursement, you'd get roughly $312 back after the deductible - submitted via photo of the invoice in the app and paid in about a week. Times and amounts vary, but this is a realistic cadence.

How to compare providers efficiently

- Shortlist 3 - 4 carriers based on reputation and policy transparency.

- Build quotes with the same settings: identical deductible, reimbursement, and annual limit.

- Read a sample policy for each; search for "dental," "bilateral," "orthopedic," and "hereditary."

- Confirm whether exam fees and specialists (cardiology, surgery) are included.

- Check waiting periods and any orthopedic waiver requirements.

- Scan independent reviews, focusing on claims handling and denials, not just price.

- Model two scenarios: a $700 urgent visit and a $5,000 surgery; compare your out-of-pocket across plans.

- Revisit at renewal; you can switch, but note that pre-existing definitions reset with a new insurer.

Flexibility often beats the lowest sticker price

Look for plans that let you change deductibles at renewal, add or remove wellness, and adjust annual limits. Flexibility helps you adapt as your small dog ages, dental needs evolve, or income changes. If a plan is slightly pricier but clearer, with fewer gotchas, it may be the better long-term partner.

When it may not fit

- You maintain a robust emergency fund and prefer to self-insure minor and moderate care.

- Your dog has multiple established conditions that a new policy won't cover.

- You want only routine care covered; wellness add-ons rarely "beat the house" dollar-for-dollar.

Quick decision cues

- Prioritize high annual limits if you worry about complex surgery or chronic heart disease.

- Prioritize low deductibles if you expect frequent small-to-midsize claims (dental, cough, GI flare-ups).

- Add wellness only if it meaningfully offsets dental cleaning and vaccines you already plan to do.

- Skip a plan that excludes dental illness or imposes strict bilateral clauses that don't fit your dog's risks.

Bottom line

There isn't a universal "best" pet insurance small dog plan. Aim for clear hereditary and dental illness coverage, a deductible that matches your cash flow, and a limit that can shoulder rare but heavy costs. Get a few matched quotes, read the specimen policy, and pressure-test with two or three real scenarios. I can't promise you'll save money every single year, but you'll likely trade uncertainty for steadier, more predictable care.